Discovery Silver Corp has delivered impressive third quarter results for 2025, showcasing significant growth in gold production and substantial free cash flow generation. The Toronto-based mining company reported producing 63,154 ounces of gold during the quarter, marking a substantial increase from the previous period while generating $86.8 million in free cash flow.

Strong Financial Performance

The company demonstrated remarkable financial improvement, swinging from a net loss of $3.9 million in Q3 2024 to net earnings of $42.4 million ($0.05 per share) in the current quarter. Adjusted net earnings reached an even more impressive $61.1 million, or $0.08 per share. This dramatic turnaround reflects the successful integration of the Porcupine Complex acquisition completed earlier this year.

Revenue surged to $236.961 million for the quarter, driven by increased gold sales and favorable pricing. The company sold 66,200 ounces of gold during Q3 2025, representing a 56% increase from the 42,550 ounces sold in the previous quarter. The average realized gold price strengthened to $3,489 per ounce, contributing to the robust financial performance.

Operational Excellence and Cost Management

Discovery Silver maintained disciplined cost control throughout the quarter. Operating cash costs remained stable at $1,339 per ounce sold, virtually unchanged from the $1,341 per ounce recorded in Q2 2025. The company's all-in sustaining costs averaged $1,734 per ounce sold, creating attractive margins given the strong gold price environment.

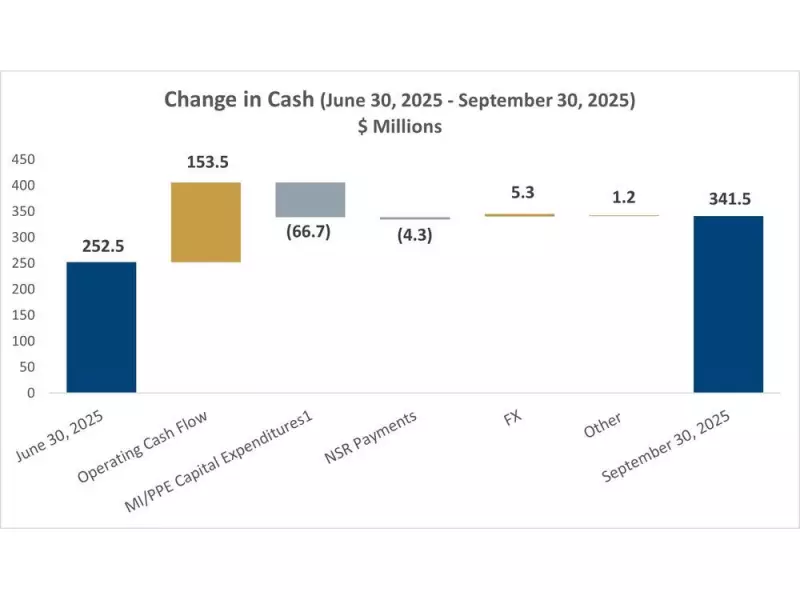

The company generated $153.5 million in net cash from operating activities, demonstrating the operational efficiency of its mining operations. This strong cash flow performance enabled significant investment in mine development and property, plant, and equipment, totaling $66.675 million during the quarter.

Strengthened Financial Position

Discovery Silver's cash position grew substantially, increasing by 35% to reach $341.5 million as of September 30, 2025. The company also reported working capital of $224.2 million, providing ample liquidity to support ongoing operations and future growth initiatives.

The company has secured a new revolving credit facility that will allow borrowing of up to $250 million, with an additional accordion feature for $100 million if needed. This financial flexibility, combined with the strong cash position, positions Discovery Silver well for executing its strategic investment plans aimed at growing production and improving operational costs.

Exploration Success and Future Potential

Following the quarter's end, Discovery Silver released encouraging exploration results that point to significant future growth potential. Resource conversion and expansion drilling at key sites including Hoyle Pond, Borden, and Pamour returned excellent results that could substantially enhance the company's resource base.

Particularly promising results emerged from Owl Creek, where drilling confirmed the potential for significant high-grade mineralization approximately three kilometers west of the existing Hoyle Pond operation. The company has also commenced drilling programs at Dome Mine and the TVZ Zone, both of which have the potential to become new mining operations that could substantially increase production in the Timmins region.

Tony Makuch, Discovery's CEO, emphasized the company's progress, stating that they have continued to integrate systems and strengthen management structures while advancing investment programs at the Porcupine Complex. The studies evaluating Dome and TVZ projects are targeted for completion in 2026, which could unlock additional value for the company and its shareholders.