In a year-end address to shareholders, ValOre Metals Corp. Chief Executive Officer Nick Smart has detailed the company's significant achievements over the past year and charted a strategic course for growth in 2026. The Vancouver-based exploration and development company is poised to build on a year of transition and progress at its flagship asset.

A Year of Strategic Progress and Leadership

The year 2025 marked a period of substantial development for ValOre. The company advanced its flagship Pedra Branca Platinum Group Elements project located in Brazil. Key operational milestones included the completion of a Trado® auger drilling program at the Esbarro deposit, which is part of the larger project.

On the regulatory front, ValOre received approval for Final Exploration Reports on crucial mineral claims, a step that represents a major advancement in the project's bureaucratic pathway. Furthermore, the company initiated a metallurgical testwork program in collaboration with the University of Cape Town in South Africa, aiming to optimize recovery processes for the precious metals.

October 2025 saw a significant leadership change, with Nick Smart assuming the role of Chief Executive Officer. In his New Year's message, Smart expressed enthusiasm for the company's direction and the opportunities that lie ahead.

Building Momentum for 2026: Engineering and Economics

Looking forward, ValOre is set to accelerate its development plans. A pivotal recent move was the engagement of the respected engineering firm Lycopodium as the lead process engineering consultant for the Pedra Branca project. This partnership brings extensive project knowledge and experience to ValOre's team, significantly strengthening the technical foundation for future development.

The company plans to expand its metallurgical testwork with the University of Cape Town, leveraging Lycopodium's expertise. This work is a critical precursor to submitting licensing applications and, most notably, to completing a Preliminary Economic Assessment (PEA). ValOre anticipates publishing this key economic study later in 2026, which will provide a clearer picture of the project's potential viability and scale.

A Broader Vision in a Favorable Market

Beyond the specific steps at Pedra Branca, CEO Nick Smart outlined a broader corporate ambition. ValOre aims to evolve from a pure-play exploration company into an integrated precious-metals producer. The strategy involves capturing new opportunities within Brazil's critical and precious metals sector, focusing on the country's most prospective regions.

Smart characterized ValOre as a "lean, active explorer & developer" positioned to create shareholder value. He noted that while market conditions are competitive, they are also ripe with possibility for companies with high-quality assets, experienced teams, and an agile approach.

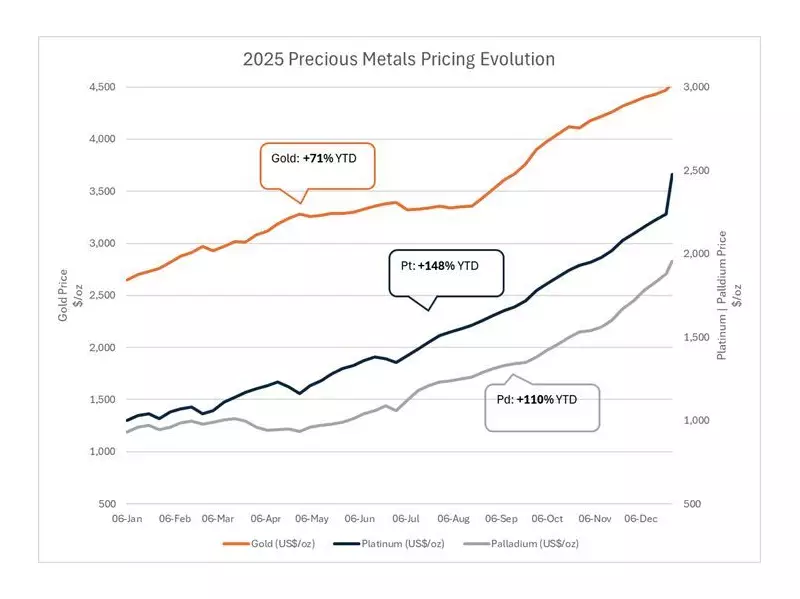

The CEO's message also touched on the supportive macroeconomic backdrop for precious metals. Gold achieved record highs above $4,400 per ounce in 2025, driven by geopolitical uncertainty and monetary policy expectations. Perhaps more impactful for ValOre's primary focus was the dramatic recovery in Platinum Group Metals (PGM).

After a prolonged period of depressed prices, both platinum and palladium staged a remarkable rally in the latter half of 2025, with values nearly doubling from levels at or below $1,000 per ounce. This resurgence in PGM prices provides a significantly improved commodity environment for developers like ValOre, whose Pedra Branca project is rich in these metals.

As ValOre Metals turns the page to 2026, the company is focused on executing a clear plan: de-risking its core asset through advanced engineering and economic studies while positioning itself strategically within a strengthening precious metals market.