The S&P/TSX composite index closed higher on Monday, January 12, 2026, buoyed by a surge in gold-related shares, while U.S. equity markets delivered a mixed performance amid startling news concerning the Federal Reserve.

Market Movements and Key Driver

Canada's main stock index found positive territory, largely thanks to significant gains in the materials sector, specifically gold mining stocks. This upward movement provided a counterbalance to other areas of the market that faced pressure. South of the border, the picture was less uniform. U.S. stock markets ended the trading session without a clear direction, with major indices split between modest gains and losses.

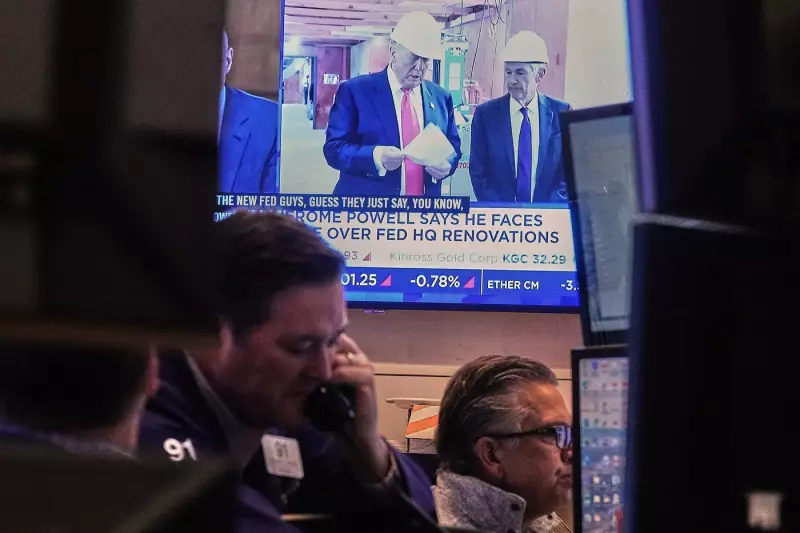

Federal Reserve Chair Faces Legal Threat

The mixed sentiment in the United States was heavily influenced by a major development from the central bank. Federal Reserve Chair Jerome Powell revealed that the U.S. Department of Justice is threatening a criminal indictment against the Federal Reserve. The specific allegations behind this unprecedented legal threat were not detailed in the initial reports. This news sent ripples through financial circles, creating uncertainty and contributing to the indecisive close on Wall Street.

Broader Economic Context

The trading day unfolded against a backdrop of ongoing economic concerns. A separate report from MNP indicated that many Canadians anticipate 2026 to be a challenging year for their personal finances, expecting to face more debt issues. This domestic concern highlights the fragile economic environment in which the day's market movements occurred. The potential for a criminal proceeding against the head of the U.S. central bank adds a profound new layer of geopolitical and financial risk, the full implications of which are yet to be understood by investors globally.