VANCOUVER - Copper Quest Exploration Inc. has taken a significant step toward expanding its mining portfolio by securing an option to purchase the historically productive Alpine Gold Property in British Columbia's mineral-rich West Kootenay region.

Strategic Acquisition in Promising Mining Region

The Vancouver-based company, trading under symbols CQX on the CSE, IMIMF on the OTCQB, and 3MX on the Frankfurt Exchange, confirmed it entered into an arms-length Option to Purchase Agreement with 0847114 B.C. Ltd. on November 7, 2025. This agreement grants Copper Quest access to a property that holds considerable potential for near-term gold production and resource expansion.

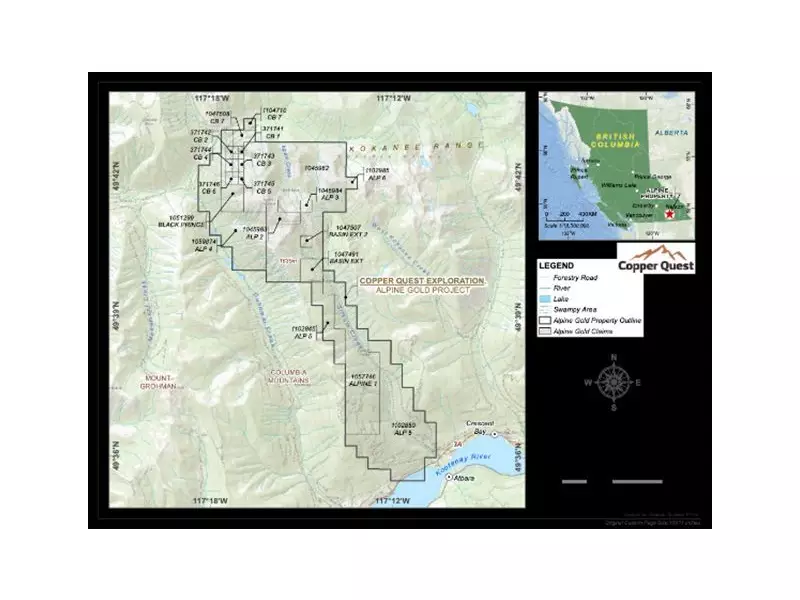

The Alpine Gold Property represents a strategic acquisition for Copper Quest, particularly given current strong gold markets. The 4,611.49-hectare property is situated approximately 20 kilometers northeast of Nelson, British Columbia, providing excellent accessibility and all-season operation potential.

Substantial Resource Base with Expansion Potential

The property's value proposition is underscored by a 2018 NI43-101 inferred resource estimate of 268,000 tonnes with an average grade of 16.52 grams per tonne gold, representing approximately 142,000 ounces of gold using a 5.0 g/t Au cut-off grade. Perhaps more exciting for investors is the substantial opportunity to expand this maiden resource.

Only about 300 meters of the approximately 2-kilometer-long vein system has been explored to date through underground mine workings and drilling. This leaves significant potential for resource growth both along strike and at depth. The property also hosts at least four additional relatively unexplored vein systems - Black Prince, Cold Blow, Gold Crown, and the past-producing King Solomon - all of which have recorded historic high-grade gold values.

Near-Term Production Opportunities

Adding to the property's immediate appeal is an estimated 24,000 tonnes of run-of-mine mineralized stockpile already on surface, presenting a possible near-term cash flow opportunity for Copper Quest. The existing infrastructure includes 1,650 meters of clean and dry underground workings that access sampled and mineable zones.

Historical production records from the former operating underground mine indicate approximately 16,810 tonnes of mineralized vein material were processed, containing 356,360 grams of gold, 222,054 grams of silver, 49,329 kilograms of lead, and 17,167 kilograms of zinc.

Strengthened Leadership Team

Copper Quest also announced the addition of key personnel to support the Alpine Gold Property's development. Upon closing the transaction, Mr. Allan Matovich will join the Board of Directors, while Mr. Ted Muraro and Mr. John Mirko will serve as Technical Advisors. Collectively, these individuals bring over 150 years of combined mining and exploration experience to the Copper Quest team.

Brian Thurston, President & CEO of Copper Quest, expressed enthusiasm about the acquisition, stating: "With gold prices at all-time highs, the Alpine Gold property creates a tremendous opportunity to create near-term value." He further emphasized his anticipation for closing the transaction and welcoming the new team members.

The company has indicated that additional information about the Alpine Gold Property will be released in the coming weeks as they advance their due diligence and development plans for this promising asset.