In a significant move to bolster its North American operations, Toronto-based Kinross Gold Corporation has officially given the green light to construct three major organic growth projects across the United States. The decision, announced on January 15, 2026, involves substantial investments in Nevada and Washington state, aimed at extending mine life and improving the long-term cost profile of its U.S. portfolio.

Three Projects Set to Transform U.S. Portfolio

The company is proceeding with the Round Mountain Phase X and Bald Mountain Redbird 2 projects in Nevada, alongside the Kettle River-Curlew (Curlew) project in Washington. These initiatives are not just expansions; they represent a core strategic shift. Based on robust internal studies and continued positive exploration results, the projects demonstrate strong margins with an average all-in sustaining cost (AISC) of approximately $1,650 per gold equivalent ounce.

Financially, the proposition is compelling. The combined projects boast an attractive Internal Rate of Return (IRR) of 55% and a combined incremental post-tax Net Present Value (NPV) of $4.1 billion, calculated at a gold price of $4,300 per ounce. Kinross plans to self-fund the developments from its operating cash flows, with forecasted capital expenditures of about $425 million in 2026 dedicated to these projects.

Production Boost and Life Extension

The impact on Kinross's production profile is expected to be substantial. The three projects are projected to contribute significantly to maintaining the company's annual production rate of 2 million gold equivalent ounces. Specifically, they are expected to yield 400,000 gold equivalent ounces per year between 2029 and 2031. In total, the initial mine plan inventories point to 3 million gold equivalent ounces of production between 2028 and 2038.

A key benefit across all three assets is the meaningful extension of mine life. Furthermore, Kinross notes significant potential for further extensions beyond the initial mine plan, which could enhance returns and asset values even more in the future.

Deep Dive into the Key Projects

The Round Mountain Phase X underground project in Nevada is a cornerstone of Kinross's grade enhancement strategy. It adds 1.4 million gold equivalent ounces to the mine's life, extending operations by eight years to 2038. With an initial underground reserve of 1.2 million ounces at a grade of 3.2 g/t, the project boasts a post-tax NPV of $1.9 billion and an IRR of 67% at a $4,300 gold price. Its incremental life-of-mine AISC is expected to be $1,680 per ounce, helping to lower the overall cost profile at Round Mountain.

At the Bald Mountain Redbird 2 project, also in Nevada, the focus is on efficient open-pit mining. This project provides a substantial mine life extension with an incremental AISC of $1,466 per gold equivalent ounce, making it a highly cost-effective addition.

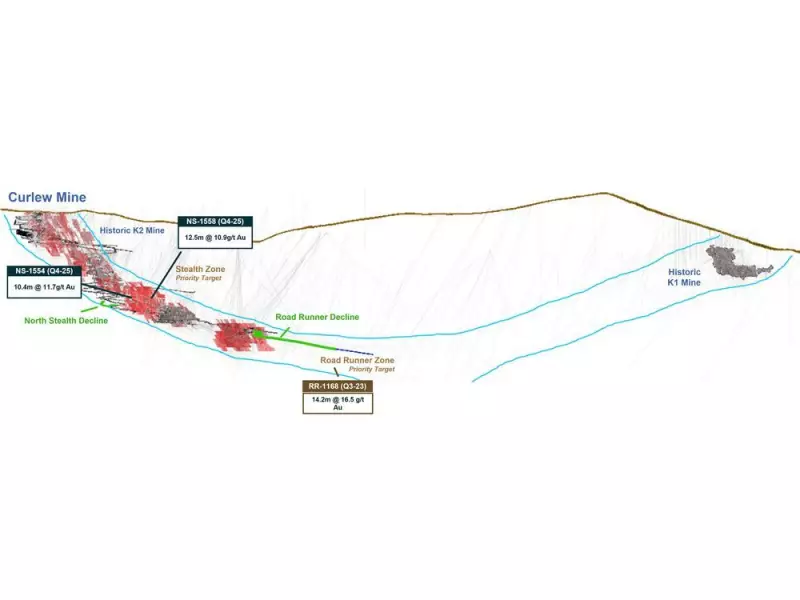

The Curlew project in Washington continues the grade enhancement theme, adding higher-grade underground ounces. This approach benefits long-term costs at a lower capital intensity and provides optionality for further extensions.

Corporate Strategy and Financial Health

This aggressive growth move is backed by a strong financial position. Kinross confirmed that as of December 31, 2025, it had completed its 2025 share repurchase program, achieving an increased target of $600 million and reducing its share count by 2.5%. The company states it will continue to prioritize a strong balance sheet, liquidity, and its return of capital program even as it invests in these new projects.

The total attributable capital expenditures for Kinross's global portfolio in 2026 are expected to reach $1.5 billion (+/- 5%), with the three U.S. projects constituting a major portion of that investment. This decision underscores Kinross's commitment to its U.S. assets and a strategy focused on organic growth, grade improvement, and cost control to drive long-term shareholder value.