Revival Gold Inc. has announced impressive new drilling results from its ongoing exploration program at the Mercur Gold Project in Utah, revealing substantial shallow oxide gold mineralization that could significantly expand the project's resource potential.

Strong Drilling Results Highlight Expansion Potential

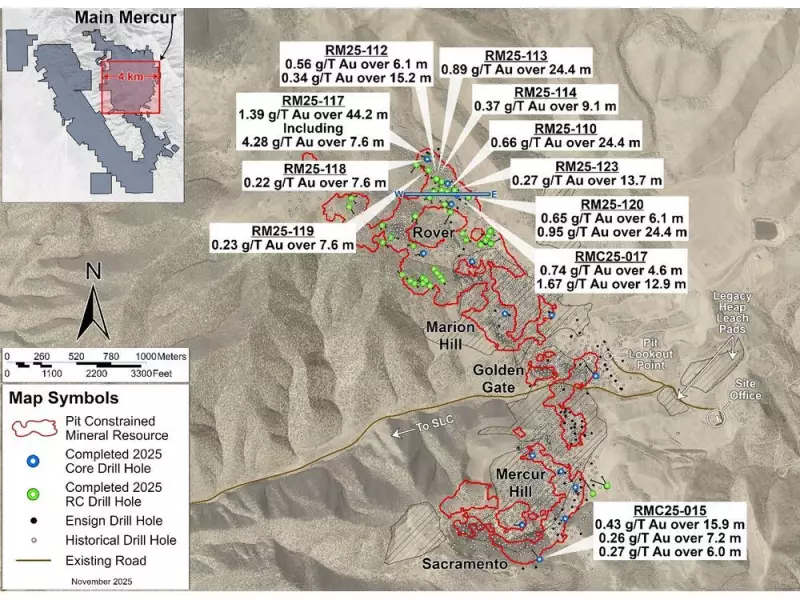

The Toronto-based company reported assay results from eleven drill holes completed at the Main Mercur area, with particularly noteworthy intersections including 1.4 grams per tonne gold over 44.2 meters in hole RM25-117. Additional significant results included 1.0 g/T gold over 24.4 meters in RM25-120 and 1.7 g/T gold over 12.9 meters in RMC25-017.

According to company officials, the intercept in hole RMC25-120 demonstrates clear potential for resource expansion down-dip from the 2025 Mercur Preliminary Economic Assessment pit shell. The shallow nature of the mineralization is particularly encouraging, with average intercept depths beginning at just 45 meters downhole.

Progress and Alignment with PEA Estimates

Revival Gold has made substantial progress in its 2025 drilling campaign, having completed 100 holes and approximately 10,000 meters of the planned 13,000-meter program. The company continues to operate three drilling rigs at Mercur with an additional rig working at its Beartrack-Arnett property in Idaho.

The latest results show strong alignment with the company's Preliminary Economic Assessment models. The weighted average fire assay gold grade across the program to date stands at 0.73 g/T, while the AuCN/AuFA ratio—a key indicator of gold leachability—measures 83%. Both metrics are consistent with the Inferred Mineral Resource and metallurgical models developed in the PEA.

Management Optimistic About Project Economics

Hugh Agro, President and CEO of Revival Gold, expressed considerable optimism about the project's prospects. "This year's drilling at Mercur continues to align with the project's PEA results and we are seeing strong indications of exploration upside beyond the current mine plan," Agro stated.

He emphasized the strategic advantages of Mercur's geological characteristics, noting that "Mercur is a shallow oxide deposit, with a strike of about 4 kilometers in the Main Mercur area alone. Shallow depths and broad deposit extent translate into lower extraction costs and meaningful mine plan expansion potential."

Agro also highlighted the favorable economic environment for gold projects, pointing out that "With Mercur's PEA economics estimated at $2,175 gold, and the current consensus long term gold price sitting at about $3,000 per ounce, projects like Mercur – which have the potential to move relatively quickly to production – offer investors significant upside exposure."

Ongoing Exploration and Future Outlook

The company's cross-section analysis through the Rover area at Main Mercur shows broad alignment between this year's drilling intercepts and the PEA block model. The visualization clearly demonstrates the intercept of oxidized mineralization in RM25-120 and its position relative to the existing PEA pit shell.

With additional assay results still pending and drilling operations continuing at full pace, Revival Gold appears positioned to deliver further positive news in the coming months. The combination of shallow, oxidized mineralization and the project's extensive strike length creates compelling conditions for continued resource growth and eventual development.

The Mercur Gold Project represents a significant asset in Revival Gold's portfolio, with the current results reinforcing the company's confidence in the property's potential to become a substantial gold producer in the favorable mining jurisdiction of Utah.