Vancouver-based Taseko Mines Limited has announced significantly improved operational and financial outcomes for the third quarter of 2025, highlighted by stronger copper production and reduced operating costs at its Gibraltar mine.

Financial Performance Shows Strength

The company reported Adjusted EBITDA of $62 million for the three months ending September 2025, demonstrating substantial operational improvement. While the company recorded a net loss of $28 million, or $0.09 per share, the more telling Adjusted net income reached $6 million, equivalent to $0.02 earnings per share.

Revenue generation remained robust with $174 million earned from the sale of 26 million pounds of copper alongside 421 thousand pounds of molybdenum during the quarter.

Gibraltar Mine Delivers Operational Improvements

Taseko's flagship Gibraltar mine demonstrated marked progress as mining operations advanced deeper into higher-grade ore zones within the Connector pit. The facility produced 27.6 million pounds of copper during the quarter, including 895 thousand pounds of copper cathode, along with 558 thousand pounds of molybdenum.

Operational metrics showed considerable improvement with mill throughput maintaining the nameplate capacity of 85,000 tons per day. The processed copper grade averaged 0.22% with recovery rates of 77%, both figures representing significant increases over previous quarters and establishing a positive trend expected to continue into the final quarter of 2025.

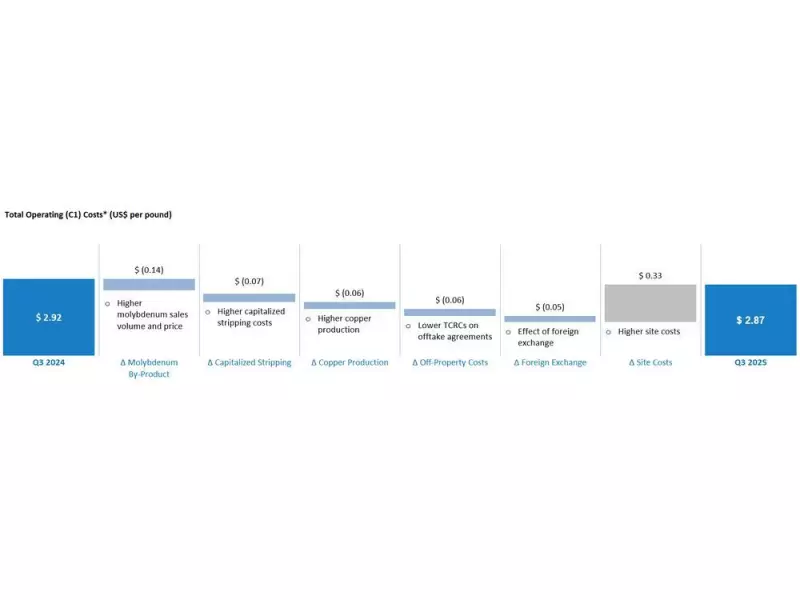

The company achieved a notable reduction in operating expenses, with total operating costs declining to US$2.87 per pound, outperforming the previous quarter and projected to decrease further in the coming months.

Florence Copper Project Advances Toward Production

Substantial progress continues at Taseko's Florence Copper project in Arizona, where the general contractor achieved substantial completion of the SX/EW plant area in September. Construction crews have begun demobilizing as attention shifts to commissioning key processing circuits.

Wellfield operations commenced in mid-October with initial solutions being injected in early November. The parallel commissioning of the SX/EW plant alongside wellfield acidification positions the facility to produce its first copper cathode early next year.

President and CEO Stuart McDonald emphasized the project's successful execution, noting that initial flow rates in the commercial wellfield have met expectations during the ramp-up phase.

The company's financial position received a significant boost through a US$173 million equity financing completed in October, strengthening the balance sheet and enabling early repayment of a US$75 million corporate revolver draw. This capital injection also facilitates the restart of wellfield drilling at Florence Copper, accelerating the production ramp-up planned for 2026.