The City of Montreal unveiled its financial plan for 2026 on Monday, January 12, 2026, charting a course of moderate tax increases coupled with targeted spending and a significant shift in fiscal discipline regarding municipal debt.

The budget, presented by the new municipal administration, outlines how taxpayer dollars will be collected and allocated in the coming year, with a focus on balancing inflationary pressures against the needs of residents and essential services.

Property Tax Increases: A Borough-by-Borough Breakdown

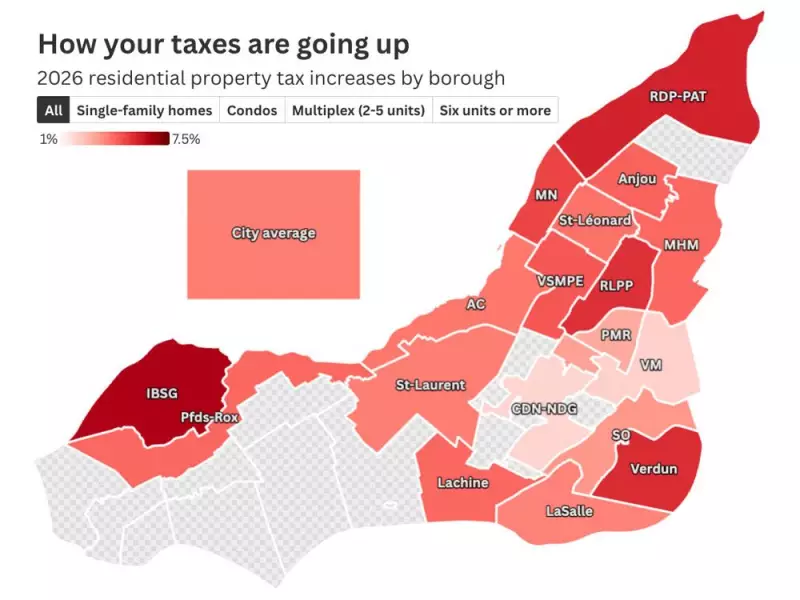

The headline figure for homeowners is an average property tax increase of 3.8 per cent across the city. This rise is positioned just below the city's calculated inflation rate of 4.0 per cent, measured between September 2024 and September 2025.

However, this average tells only part of the story. The actual impact on individual tax bills will vary significantly depending on location and property type. The final increase for each homeowner will be determined by their specific borough and the category of their dwelling, such as single-family home, condo, or multiplex.

Residents are advised to consult the detailed borough charts released with the budget to understand their precise financial obligation for the 2026 fiscal year.

Spending Priorities and Debt Management

An analysis of the budget documents shows that while there is a new government at Montreal's helm, expenditures across most categories remain largely consistent with the 2025 budget. This continuity suggests a focus on maintaining core municipal services.

One area marked for notable growth is investment in social housing. The budget allocates increased funds to address housing affordability and homelessness, signaling a key priority for the administration.

Perhaps the most striking fiscal change is Montreal's accelerated return to a more conservative debt management policy. The city is now committing to limit its debt to 100 per cent of its annual revenues, a target it is achieving one year ahead of schedule.

This marks a deliberate shift from the practices of the previous administration, under which the city's debt level climbed as high as 114 per cent of revenues. The move to a 100 per cent cap is intended to ensure long-term financial sustainability and stability.

What the 2026 Budget Means for Montrealers

The 2026 budget presents a picture of cautious fiscal management. The below-inflation property tax hike aims to mitigate the direct burden on residents while still generating necessary revenue. The sustained spending in most areas indicates a commitment to service continuity, while the boosted investment in social housing addresses a critical urban challenge.

The decisive move on debt reduction is likely to be welcomed by fiscal watchdogs, as it strengthens the city's balance sheet and could positively influence its credit rating. Together, these elements sketch the initial financial roadmap of Montreal's new government, balancing immediate needs with longer-term fiscal health.

As the details are examined more closely by borough councils and the public, the full local impact of the tax changes and spending allocations will become clearer for every community across the island.