The City of Regina has unveiled a sobering financial forecast for the 2026-27 fiscal year, projecting a substantial 15.69% mill rate increase that would significantly impact property taxpayers across the Saskatchewan capital.

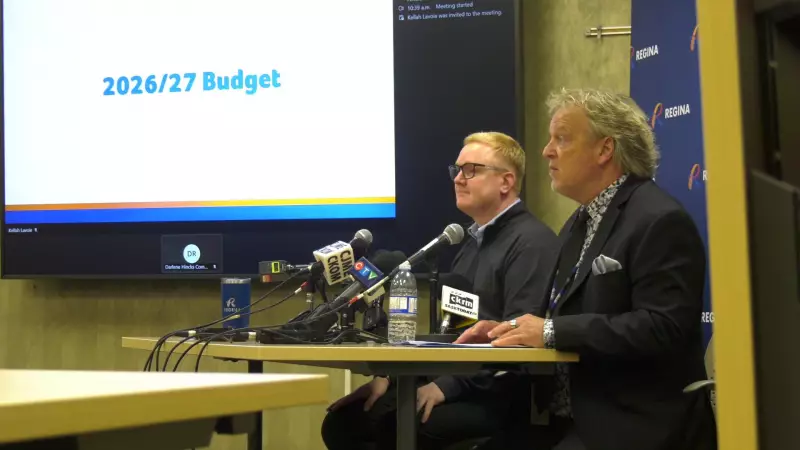

City Chief Financial Officer Daren Anderson and Acting City Manager Jim Nicol presented the proposed budget documents on November 20, 2025, marking the first official release of financial planning for the upcoming two-year cycle.

Understanding the Budget Proposal

The preliminary budget documents outline the financial challenges facing Regina's municipal government as it prepares for the 2026-27 fiscal period. The proposed 15.69% mill rate increase represents one of the most substantial property tax hikes in recent city history, though officials emphasize these are early projections subject to change during budget deliberations.

Mill rates determine how much property owners pay in municipal taxes based on their property's assessed value. A increase of this magnitude would translate to hundreds of dollars in additional annual taxes for the average Regina homeowner.

Factors Driving the Proposed Increase

While the complete details of the budget rationale will emerge during upcoming city council discussions, several factors typically influence such significant tax proposals. These often include rising infrastructure costs, increased service demands, inflationary pressures, and major capital projects requiring municipal funding.

The timing of this budget forecast allows for several months of public consultation and council debate before final approval. Regina residents and business owners will have opportunities to provide input on the proposed financial plan through scheduled public hearings and written submissions.

Next Steps in Budget Process

City administration has emphasized that this initial proposal represents the starting point for what will likely be extensive budget negotiations. Council members will scrutinize every aspect of the proposed spending plan in the coming months, with final approval expected in early 2026.

The release of these documents kicks off a transparent budgeting process that will see multiple rounds of revisions and refinements. Historical data suggests that initial mill rate projections often undergo modification as council members balance fiscal responsibility with taxpayer affordability concerns.

Regina property owners should prepare for potential tax increases while remaining engaged in the democratic process that will shape the city's financial future. The coming budget deliberations will determine whether the final mill rate increase matches, exceeds, or falls below the current 15.69% projection.